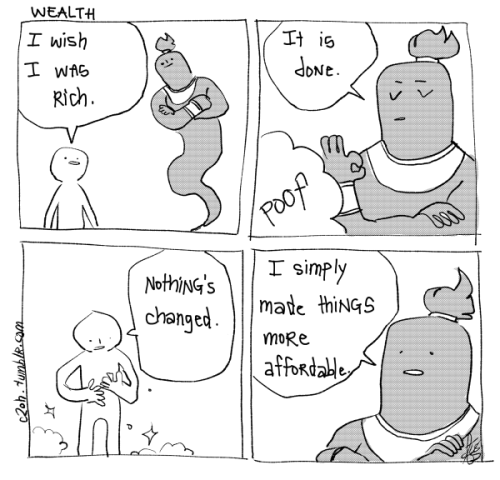

Blog: The VIX thinks the Fed genie will grant the market's wish.

Across the globe investors are hoping the Fed genie will keep everyone safe. But I, for one, am not betting on it.

These days there seems to be more and more wishful thinking going on. Despite the most widely anticipated recession in my long career, the market doesn’t appear to believe it's coming. Investors do seem to believe that a magic genie resembling Fed Chair, Jerome Powell, will appear and make things better. Certainly the usual signs of market angst are absent, particularly from the VIX.

In my blog entry back in February (“Is the VIX broken? Nope.”), I discussed the speculation that short dated options had made the VIX irrelevant. While I dismissed that idea, the VIX and other implied volatility indices (IVI) have continued falling despite:

· Stubbornly high inflation,

· Central banks continued tightening,

· Slowing economic growth, and

· The US debt ceiling circus.

What has been perplexing is not only the S&P VIX remaining low, but other implied volatilities from Europe, Emerging Markets and oil show the same trend as we can see below: